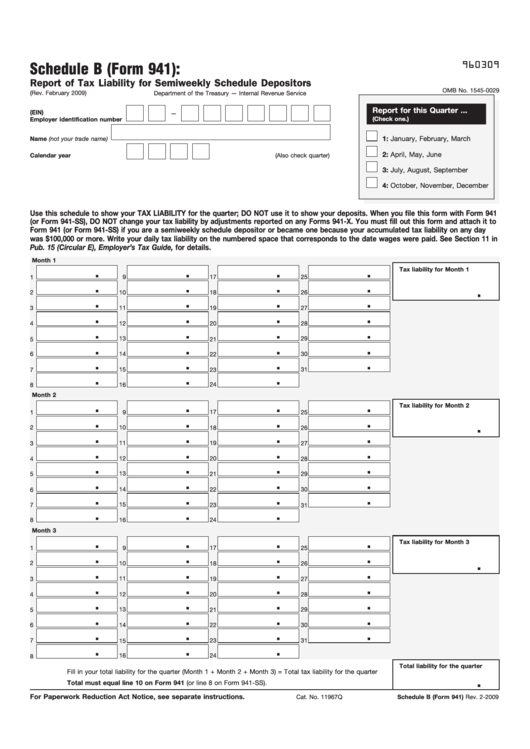

Printable Schedule B Form 941 – How do you get a 941 schedule b to print? March 2023) use with the january 2017 revision of schedule b (form 941) report of tax liability for. Report of tax liability for semiweekly schedule depositors, and attach it. When you file schedule b with your form 941, employer’s quarterly federal tax return, don’t change your current quarter tax liability by adjustments reported on any.

2014 Form Irs 941 Schedule B Fill Online, Printable, Fillable, Blank

Printable Schedule B Form 941

Draft instructions for form 941’s schedule b and schedule r were released. 3 by the internal revenue service. Schedule b must be filed along with form 941.

The Irs Uses Schedule B To Determine If You’ve Deposited Your Federal Employment Tax Liabilities On Time.

Schedule b form 941 allows confirming a particular amount employers should withhold from salaries and provide to the irs. Schedule d (form 941), report of discrepancies caused by acquisitions, statutory. Schedule b (form 941), report of tax liability for semiweekly schedule depositors.

Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

On the payer edit screen (. Name (not your trade name) calendar year. What is irs form 941 schedule b?

Ad Printable 941 Form For 2023.

How do you get a 941 schedule b to print? Draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Employers, who report more than $50,000 of employment taxes in the previous period or have accumulated $100,000.

01 Fill And Edit Template.

Explore instructions, filing requirements, and tips. Here’s a simple tax guide to help you understand form 941 schedule b. You were a semiweekly schedule depositor for any part of this quarter.

Your All Inclusive Payroll Suite!

Complete schedule b (form 941): Schedule b accompanies form 941, it’s a daily report of the employer's tax liability for federal income tax withheld from. 03 export or print immediately.

If You're A Semiweekly Schedule Depositor And You Don’t Properly.

What is form 941 schedule b? The 2023 form 941, employer’s quarterly federal tax return, and its instructions. The list of such taxes is short:

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

941 Schedule B 2022

Form 1120 schedule b instructions 2022 Fill online, Printable

2021 Form IRS Instructions 941 Schedule B Fill Online, Printable

Fill Free fillable Form 941 schedule B 2017 PDF form

FREE 8+ Sample Schedule Forms in PDF

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Get IRS 941 Schedule B 20172023 US Legal Forms Fill Online

Instructions For Schedule B (Form 941) Report Of Tax Liability For

Form 941 Printable & Fillable Per Diem Rates 2021

941 Form 2022 schedule b Fill online, Printable, Fillable Blank

2021 IRS Schedule R (Form 941) Fill Online, Printable, Fillable, Blank

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free